Get the free idbi 15g form online submission

Show details

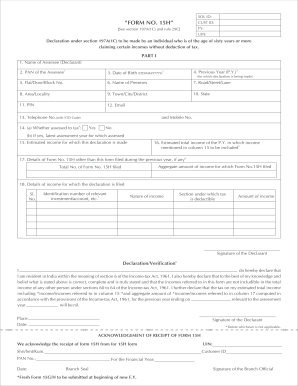

“FORM NO. 15G? See section 197A(1), 197A(1A) and rule 29C Declaration under section 197A(1) and section 197A(1A) of the Income?tax Act, 1961 to be made by an individual or a person (not being a

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your idbi 15g form online form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your idbi 15g form online form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit idbi 15g form online submission online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit idbi 15h form online submission. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

How to fill out idbi 15g form online

How to fill out IDBI 15H form online:

01

Visit the official website of IDBI Bank and navigate to the Forms section.

02

Download the IDBI 15H form from the website or directly access the online form submission portal.

03

Start by entering your personal details such as name, address, date of birth, and contact information. Ensure the accuracy of the information provided.

04

Next, provide your Permanent Account Number (PAN), which is a mandatory requirement for submitting the form.

05

Specify the assessment year for which you are submitting the form. This is important as it determines the tax liability you are claiming exemption from.

06

Declare your status as an individual taxpayer and mention your age. The IDBI 15H form is applicable to individuals who are 60 years or older.

07

Provide details of your income, including the estimated total income for the relevant assessment year and the nature of income (such as interest, dividends, etc.).

08

Calculate and mention the estimated total tax payable on the income mentioned above.

09

Sign the form electronically or print it out and sign it manually.

10

Ensure all the information provided is accurate and complete before submitting the form online or visiting the nearest IDBI Bank branch to submit a physical copy.

Who needs IDBI 15H form online:

01

Individuals who are 60 years or older and wish to claim exemption from tax deducted at source (TDS) on their income.

02

Individuals who expect their total income for the relevant assessment year to be below the taxable limit and meet the other eligibility criteria specified by the Income Tax department.

03

Investors who hold fixed deposits or other fixed income instruments and want to prevent TDS deduction on the interest earned.

04

Those who wish to avoid the hassle of claiming a refund for TDS deducted on their income by submitting the IDBI 15H form in advance.

Note: It is advisable to consult with a tax professional or seek guidance from IDBI Bank for any specific queries or clarification regarding the IDBI 15H form and its submission process.

Video instructions and help with filling out and completing idbi 15g form online submission

Instructions and Help about 15h form download

Fill idbi form 15g : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How to fill out idbi 15h form online?

1. Go to the IDBI Bank website.

2. Select the ‘Forms and Documents’ tab from the main menu.

3. Select the 15H Form from the list of forms.

4. Fill in the details in the form.

5. Attach the necessary documents.

6. Submit the form.

7. Pay the applicable fee.

8. Print out the form for future reference.

What information must be reported on idbi 15h form online?

The IDBI 15H form requires the following information to be reported:

• Name

• Permanent Account Number (PAN)

• Father's/Husband's Name

• Date of Birth

• Address

• Phone Number

• Bank Name & Branch

• Account Number

• IFSC Code

• Signature/Thumb Impression of the depositor

• Amount of Interest Earned

• Tax Deducted at Source (TDS).

When is the deadline to file idbi 15h form online in 2023?

The deadline to file IDBI 15h form online in 2023 has not yet been announced. It is best to check with your bank or financial institution for specific information regarding the filing deadline.

What is idbi 15h form online?

IDBI 15H form is a declaration form required by the Income Tax Department of India for tax exemption on interest incomes. It is specifically applicable for senior citizens (above the age of 60) to avail of the benefit of claiming exemption from Tax Deducted at Source (TDS) on interest payments. The 15H form needs to be submitted by eligible individuals to the institution where their fixed deposit or other interest-bearing savings accounts are held. This can be done both online and offline, depending on the facility provided by the particular institution or bank. The purpose of this form is to declare that the individual's total income for the financial year is below the taxable limit, and hence, TDS should not be deducted on their interest income.

Who is required to file idbi 15h form online?

IDBI 15H form is required to be filed by individuals above the age of 60 years who are resident Indians and wish to claim exemption from tax deduction at source (TDS) on their income. This form is applicable for individuals whose total income is below the taxable limit.

What is the purpose of idbi 15h form online?

The purpose of the IDBI 15H form online is to declare that an individual, who is a senior citizen and earns interest income below the taxable limit, is seeking exemption from the deduction of Tax Deducted at Source (TDS). By submitting this form, the individual is confirming that they are eligible for exemption from TDS and that their income falls within the prescribed limit.

What is the penalty for the late filing of idbi 15h form online?

There is no specific information available regarding the penalty for the late filing of IDBI 15H form online. It is always recommended to file the form on time to avoid any potential penalties or consequences. It is advised to consult with a professional or the IDBI Bank for accurate and up-to-date information regarding the filing process and any associated penalties.

How do I execute idbi 15g form online submission online?

pdfFiller has made it simple to fill out and eSign idbi 15h form online submission. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I create an electronic signature for signing my how to fill form 15g online in idbi bank in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your form 15h download and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

Can I edit idbi bank form 15g filing online on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign idbi bank 15g online form right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

Fill out your idbi 15g form online online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

How To Fill Form 15g Online In Idbi Bank is not the form you're looking for?Search for another form here.

Keywords relevant to idbi bank form 15h filing online

Related to idbi bank 15h form download

If you believe that this page should be taken down, please follow our DMCA take down process

here

.